kentucky property tax calculator

However rates can vary wildly depending on where you live within the county. The median annual property tax paid by homeowners in New Mexico is 1403 about 1200 less than the US.

One reason property taxes in New Mexico are so low is that the state has capped the amount the taxable value of a property can increase in a year at 3.

. Likewise the states average effective property tax rate is 078. Riverside County taxpayers face some of the highest property tax rates in California. Riverside County CA Property Tax Calculator.

The countys average effective tax rate is 095. Overview of Riverside County CA Taxes.

Kentucky Property Taxes By County 2022

Hopkins County Taxes Madisonville Hopkins County Economic Development Corporation

Kentucky Property Tax Calculator Smartasset

State Income Tax Rates And Brackets 2022 Tax Foundation

Chart 50 Highest Real Estate Tax Levies By Kentucky School Districts 89 3 Wfpl News Louisville

Property Taxes By State County Lowest Property Taxes In The Us Mapped

North Central Illinois Economic Development Corporation Property Taxes

Property Tax Rate Will Stay The Same City Of Covington Ky

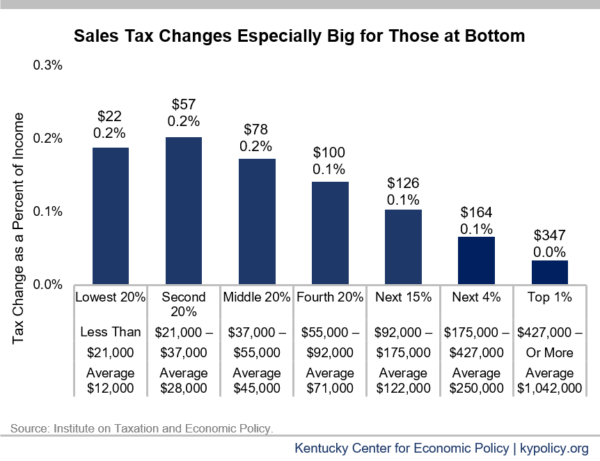

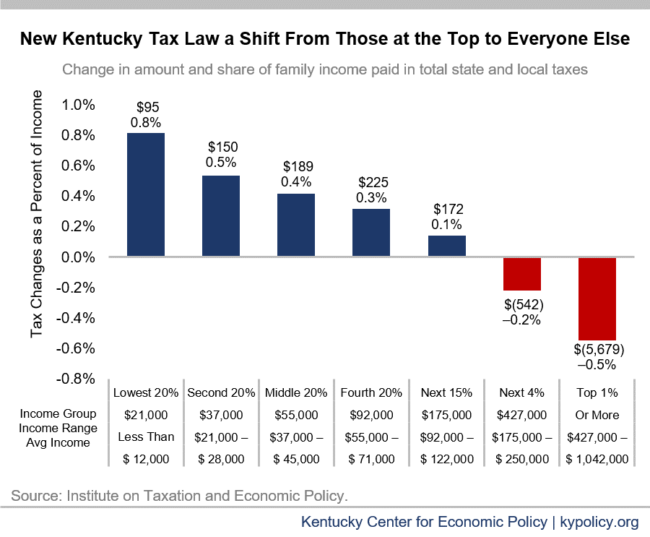

Kentucky Tax Shift Going Into Effect Kentucky Center For Economic Policy

Jefferson County Ky Property Tax Calculator Smartasset

Kentucky Property Tax Calculator Smartasset

Kentucky Income Tax Calculator Smartasset

How Do Tax Rates On The Poor Compare To Taxes On The Rich In Your State Itep

Kentucky Tax Shift Going Into Effect Kentucky Center For Economic Policy

Jefferson County Ky Property Tax Calculator Smartasset